Table Of Content

This is the money you pay upfront to offset the amount you need to borrow. The best way to avoid wasting time is to know the players and the process. Buying a new home is a complex undertaking, even if you’ve been through it before. Explore our easy-to-follow home buying checklist to understand the process. You should do a final walk-through of your new home before you close, even if you’re 100% committed to the property.

What Do You Need To Buy a House? 7 Checklist Items

Jamie Johnson is a Kansas City-based freelance writer who writes about a variety of personal finance topics, including loans, building credit, and paying down debt. The loan-to-value ratio (LTV) is another factor used to determine how you qualify for a home loan. Your LTV is the loan amount divided by the home’s purchase price. If you want to qualify for a loan and your credit score isn’t up to par, you can take actionable steps to improve your credit score. Let’s walk through some of the ways to increase your score before buying a house.

Income And Job History

Looking to buy a beach home in California or hoping to sell your house? You might want to familiarize yourself with the state’s regulations. Such rules led to an industrywide standard commission that hovers near 6 percent, the lawsuits said. A settlement that will rewrite the way many real estate agents are paid in the United States has received preliminary approval from a federal judge. Explore different home-buying costs, like the down payment and closing costs, to determine how much money you need to buy a house. And you may even be able to buy a home with no money down if you qualify for a VA or a USDA loan.

How to get a mortgage step-by-step

A 20% down payment would keep many home buyers locked out of the housing market. Fortunately, 20% is no longer the benchmark for a down payment on a house. According to the National Association of REALTORS®, in 2022, the average down payment was 6% for first-time home buyers and 17% for repeat buyers. Finding the right home is often the most time-consuming part of buying a home. Once you're under contract, mortgage underwriting typically takes the next largest chunk of time. Once you're preapproved for a mortgage and know how much house you can afford, you can start searching for a home.

The preliminary approval of the settlement comes as the Justice Department reopens its own investigation into the trade group. They now have the green light to scrutinize those fees and other N.A.R. rules that have long confounded consumers. VA loans and USDA loans can have a zero-down payment, but you must meet the minimum qualifications set by both programs. You can buy a home with no money down if you qualify for a Department of Veterans Affairs (VA) loan or a U.S. VA loans are mortgage loans for current and former military personnel and surviving spouses who meet the VA’s criteria.

What credit score do you need to secure a mortgage? - CNBC

What credit score do you need to secure a mortgage?.

Posted: Fri, 09 Feb 2024 08:00:00 GMT [source]

You’ll have a firm understanding beforehand, based on your closing disclosure. Be sure to ask what type of payment is accepted for all your closing costs, as you’ll likely need to go get a certified check or a cashier’s check. Then, when closing day arrives, be sure to bring the proper identification, and be ready to sign a mountain of paperwork. Once you’ve completed all the necessary work, the keys are yours.

Learn when that may change and explore other tax breaks you can benefit from. You may also be considered a first-time home buyer if you haven’t owned a home in the last 3 years. So, under this definition, previous homeowners can be classified as a first-time home buyer again after enough time has passed. To calculate your credit utilization ratio, simply divide how much you owe on your card by how much spending power you have. For example, if you typically charge $2,000 per month on your credit card, divide $2,000 by your total credit limit of $10,000. There are many ways to calculate a credit score, but the most sophisticated, well-known scoring models are the FICO®Score and VantageScore® models.

The compensation we receive may impact how products and links appear on our site. Each mortgage has a loan term, which is the amount of time over which you’ll repay the balance. Mortgage payment schedules often range from 10 to 30 years, with 30-year terms being the most common.

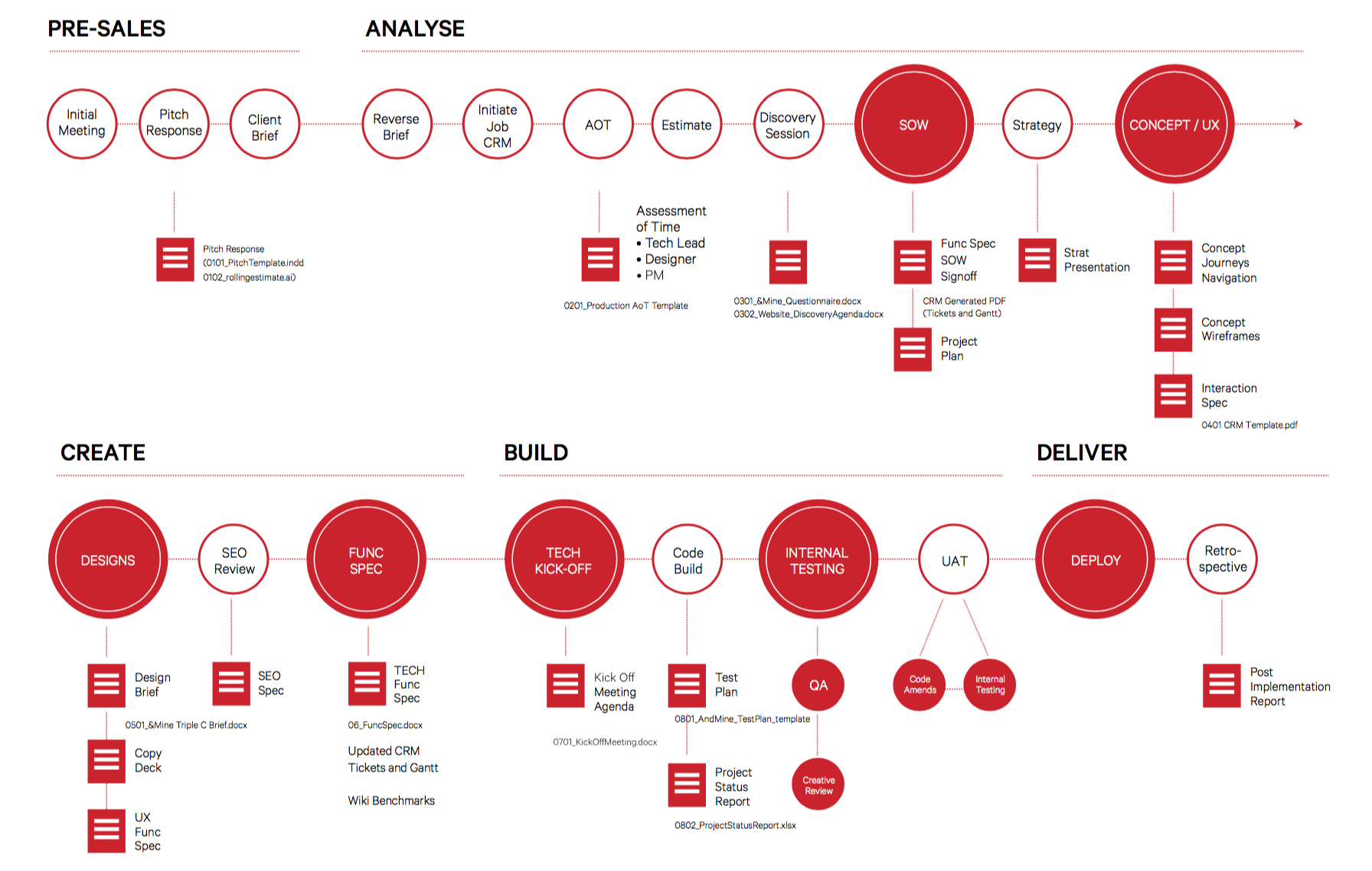

The seller will either accept, decline, or counter your purchase offer. If the seller declines, you have the option to make a counter offer. Click the image to open a PDF version of the home buying checklist.

If you have a strong credit score, you'll have a better chance of securing a good mortgage rate. Real estate agents should be equipped to handle any negotiations throughout the home buying process, provide advice on the housing market and help with navigating paperwork as needed. While it might be tempting to focus on the furniture you’ll buy or the color of paint you should choose for your new walls, home decor details like this should take a backseat. First, concentrate on the criteria a lender will use to judge your finances and your ability to make mortgage payments. A lender will evaluate your finances and qualifications as a borrower based on a range of criteria before you’ll be approved for a mortgage to buy a house. The first step, though, is having a good financial plan from the start.

There are many loan types and mortgage lenders that allow lower scores. But in general, a lower score means you might find it harder to get approved for a mortgage, and you likely won't have access to the best rates. You’ll owe a lot of money at the end of your loan, and if you can’t pay it off, you could lose your home. Balloon mortgages aren’t commonly used by traditional buyers, but are more popular among real estate investors and flippers. For a conventional mortgage, lenders generally prefer a DTI of no higher than 43%.

Working with an agent can help you navigate the real estate market, submit a legally sound offer and avoid overpaying for your property. Multiple people are involved when getting a mortgage and buying a house. As your representative in the home purchase transaction, your real estate agent will look out for your best interests by finding homes that meet your criteria. These local market experts also get you showings, help you write offers and negotiate on your behalf. Conventional loans aren’t guaranteed or backed by a government agency. These loans are best suited to borrowers who have higher credit scores and money saved up for a down payment.

New York First-Time Home Buyer Programs & Grants - The Mortgage Reports

New York First-Time Home Buyer Programs & Grants.

Posted: Fri, 19 Apr 2024 07:00:00 GMT [source]

Those with scores of 740 or higher will usually get the best loan terms. There are also programs to help those people with credit scores in the 500s become homeowners. For a government-backed loan (these include FHA, VA, and USDA loans), you may be able to qualify with a credit score in the 500s. For an FHA loan, 580 is the minimum score to qualify for the 3.5% down payment advantage. Lenders may require a minimum score of 580 for a VA loan; and for a USDA loan, 640.

But if you're wanting to qualify for the lowest rates, try to get your score at least within the "Very Good" range (740 to 799). A mortgage is a type of secured loan, meaning it’s backed by collateral -- in this case, the house itself. If you don’t repay the loan as promised, the lender has the right to seize the property in a process called foreclosure. This guide can serve as an entry point to explain the most common loan types, what’s required for approval and who each type of mortgage is best for. There are several types of mortgages, each offering unique characteristics and benefits. The right type of home loan depends on your credit score, down payment, location and more.

That said, making a down payment that equals 20% of a home’s purchase price offers advantages. Getting preapproved with multiple lenders lets you compare loan offers to find the best interest rate and terms. Remember that preapproval counts as a hard inquiry on your credit report, which can lower your score. However, if made over a short period (typically 45 days), various applications for a single loan count as one inquiry. The answer depends on how much you earn each month, how much you have in the bank, how much you must spend on other debts and how much houses cost in your particular part of the state.

You don’t need 20 percent down and a credit score in the high 700s to buy a home. By getting pre-approved, avoiding dual agency, and sticking to your budget, you can make yourself a competitive buyer. If you’re a salaried employee, proof of income means showing pay stubs and a year-end W-2 statement. If you’re self-employed, you’ll need to show tax returns and evidence of your business. If you have a job offer letter but haven’t started work yet, you’ll need proof of the job offer signed by all parties.

No comments:

Post a Comment